News

SEP Update Released June 2023 Edition.

SEP UPDATE RELEASED June 2023 EDITION!

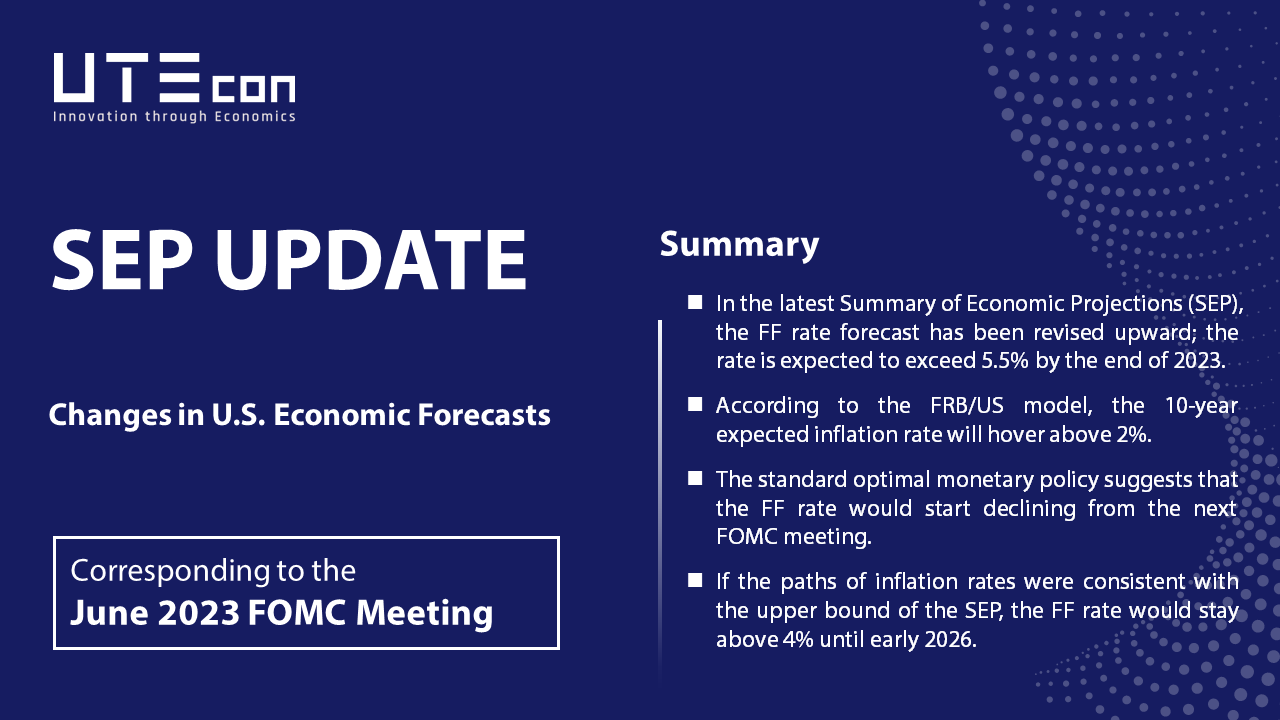

Every other Federal Open Market Committee (FOMC) meeting, the Federal Reserve System (Fed) publishes the “Summary of Economic Projections (SEP),” illustrating the FOMC members’ forecasts of key macroeconomic variables over the next three years. The SEP is an important piece of information on the future direction of U.S. monetary policy and attracts a great deal of attention from market participants.

The SEP contains projections of five variables—GDP growth, unemployment, inflation, core inflation, and the FF rate—in annual frequency over the next three years and their long-run values. However, some market participants might be interested in projections of other macroeconomic and financial variables and quarterly fluctuations in these variables.

Our “SEP Update” provides projections consistent with the SEP of a variety of macroeconomic and financial variables, using a publicly available version of the FRB/US model, a macroeconomic model used frequently by the FRB in policy analysis.

- Advantages of SEP Update

Prepared by experts in monetary policy analysis

Written by experts with leading international knowledge in economic forecasting.

Meets the needs of market participants

The SEP contains projections of five variables—GDP growth, unemployment, inflation, core inflation, and the FF rate—in annual frequency over the next three years and their long-run values.

“SEP Update” provides projections of other macroeconomic and financial variables and also quarterly fluctuations and longer term forecasts than SEP in these variables.

Provides scenario-based analysis

In addition to a forecast based on the Fed’s projections, we provide analysis along with scenarios of interest to market participants.

The June 2023 edition provides projections of SEP forecast variables and medium- and long-term interest rates under the following two scenarios.

(1) If the central bank optimally sets policy rates so as to minimize deviations from inflation and unemployment targets and the volatility of the policy rate

(2) If the paths of inflation rates are consistent with the upper bound of the SEP